| Boy

Seeks Bankruptcy in Bid to Save Home

| |

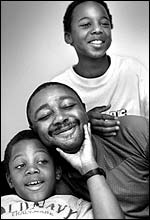

Shawn Powell, left, and his

brother, Ray Jr., hug their uncle, Jeffrey Powell. (By Juana Arias – The Washington

Post)

|

By Ruben Castaneda and Brian Mooar

Washington Post Staff Writers

Thursday, August 27, 1998; Page

D1

At first glance, Chapter 13 petition No. 98-21013DK looks like any of

the other 10,200 bankruptcy applications filed this year in U.S.

District Court in Greenbelt.

A clue that Shawn Powell's financial predicament is different from

that of most people seeking court protection from creditors appears on

Schedule B, where the debtor lists assets – checking and savings

accounts, pension plans, video, audio and computer equipment, jewelry

and furs.

Shawn's filing lists these assets: Toys, $100. Clothing, $100.

Shawn Powell is 10 years old. But the intelligent, bright-eyed boy's

trip to bankruptcy court isn't child's play.

Six months after he and his brother and sister were orphaned, Shawn

has filed for Chapter 13 protection in a novel effort to save the Laurel

home his parents bought eight years ago.

The children's father died of liver disease in February; almost

exactly a year before, their mother died in a car accident.

In recent months, Shawn and his brother, Ray Jr., 12, have been

living in their family's one-story house, cared for by an uncle. Their

8-year-old sister, Tracy, lives with a female relative in Silver Spring.

Last week, one day before an Oklahoma City mortgage company was to

foreclose on their home, Shawn filed for bankruptcy with the help of

Olney lawyer Brett Weiss, staving off eviction.

The filing is a stopgap gambit, Weiss said. He hopes it will buy

enough time for the children to collect $100,000 from their father's

life insurance policy, which would allow them to pay what they owe and

stay in the well-kept home.

Shawn's plight is not so much caused by uncaring bankers as by a

compilation of family tragedies and bureaucratic red tape.

"These kids have been through more in their lives than most

50-year-olds," Weiss said. "They've lost their childhood.

Right now, they're struggling to maintain a sense of place."

According to Shawn's bankruptcy petition, back payments on the

mortgage total $15,000. Even before his death, Shawn's father had not

made five monthly payments of $1,353 each. The payoff on the mortgage is

$133,000.

In an interview, the boys and the uncle who is caring for them,

Jeffrey Powell, 36, said the father, Ray Powell Sr., was a recovering

alcoholic with more than a dozen years of sobriety when his wife,

Patricia, was killed in a one-car accident in Montgomery County.

After his wife's death, Ray Powell Sr. started careening toward his

own death, his boys and his brother said: He picked up the bottle and

let go of his family responsibilities, binging on booze and buying a new

truck and a Corvette.

"He stopped caring," Jeffrey Powell said. "He went off

the deep end."

Days before he drank himself to death, Ray told him he knew he was

going to die, Jeffrey said. "I asked him about the kids, and he

said I could take them."

Jeffrey Powell stepped in, caring for the boys in the home they had

grown up in, feeding and clothing them, making sure they got to school.

The bond between the boys and their uncle is evident; during an

interview, they draped themselves over his shoulders.

But money has been a problem.

Jeffrey Powell, who is unable to work because of a serious stab wound

he suffered during an argument with an associate two years ago, receives

$484 monthly in disability payments. Shawn and Ray Jr. each receive $327

a month in Social Security.

The money stretches enough to pay for utilities, the phone, clothes

and food – but not the mortgage, Jeffrey Powell said.

In May, letters from lawyers began arriving at the Powell home,

notifying them that the mortgage was in default. Asked yesterday to

comment, a representative of the Midland Mortgage Co. said a written

release from the mortgagees – the children's dead parents – would be

required before a statement could be made.

As foreclosure loomed, Jeffrey Powell's efforts to obtain the

benefits for the children from Ray Powell's life insurance policy were

unsuccessful. In a letter to Ray Powell Jr., an official with the

insurance company said a court-appointed guardian had to complete the

claim form before the money would be paid out. An insurance

representative did not respond to a request for a comment.

Weiss, whom Jeffrey Powell hired this month to represent his nephews,

devised a two-part plan: He filed a petition with Prince George's County

Circuit Court seeking to have Jeffrey Powell named the guardian of all

three Powell children. Then, last week, he had Shawn Powell file for

bankruptcy, staving off foreclosure.

Weiss said Shawn was chosen because a bankruptcy filing stays on

one's credit record for 10 years. By then, Shawn will be 20 and would be

less affected than Ray Jr., who will be 22, Weiss said.

Prince George's County social service caseworkers will investigate

Powell to determine whether he is fit to be a guardian, Weiss said. The

attorney said he believes Powell will be certified as the children's

guardian by November, freeing up the insurance money, which would then

be used to pay the mortgage arrearage and the monthly mortgage payments.

"At some point, that money will run out," Weiss said.

Filing for Chapter 13 allows a person to regroup and pay off debts

under the supervision of a court trustee. The bankruptcy court may not

extend such protection to a 10-year-old with no income.

Asked whether he knew what it meant to file for bankruptcy, Shawn –

who may be the youngest person ever to seek Chapter 13 protection –

replied: "Nope. Yeah, kind of. It means I don't have any

money."

© Copyright 1998 The Washington Post Company

Back

to the top

|