OPEN LETTER TO THE EIA AND US DOE

We find most of the Energy Information Administration (EIA) projections for 2002 very useful and thank the EIA for their public service and reasonable NEMS work. However, we accuse the EIA of "oil production fixing on paper." The EIA has intentionally and artificially inflated the OPEC oil production schedule for the next 20 years, for no apparently justifiable reason. We strongly oppose the following unrealistic projections regarding foreign oil production in Director Mary Hutzler's AEO 2002 (taken from her speech transcript on the EIA website www.eia.doe.gov ):

"World oil demand is projected to increase from 76.0 million barrels per day in 2000 to 118.9 million barrels per day in 2020, higher than the AEO2001 projection of 117.4 million barrels per day, due to higher projected demand in the United States and developing countries, including the Pacific Rim and Central and South America. Growth in oil production in both OPEC and non-OPEC nations leads to the relatively slow growth of prices through 2020. OPEC oil production is expected to reach 57.5 million barrels per day in 2020, nearly double the 30.9 million barrels per day produced in 2000,

assuming sufficient capital to expand production capacity..."Should we also add, and sufficient political might to force OPEC to change their production schedule?. This is probably the most controversial, unfounded, and deceptive prediction of the DOE EIA AEO, apparently designed to quell growing public anxiety and uncertainty. We would like to believe, as it is stated on the EIA website that, "EIA is an independent statistical agency." However, being in the DOE, with its present oil baron executive administration, apparently has warped the EIA sense of honesty, ethics and realism. Has anyone at EIA or DOE reviewed the news from OPEC in the past two years

www.opec.com? It is a rude awakening. In 2000, the following OPEC news was created, (Washington Post, 9-29-00 article, excerpt attached): "Saudi Arabia is the only OPEC nation with the capability to boost oil production significantly, a move that would harm the finances of other member nations..." Therefore, it is more reasonable and prudent to prepare for a flat production schedule and warn the public that CONSERVATION is necessary! ("Conservation" is a word that Europe is using extensively now and the US DOE is supposed to be using by law.) The Congressional declaration of purpose for the DOE indicates that, among other duties, the DOE is to "promote maximum possible energy conservation measures" (42 USC Sec. 7112). On June 26, 2002, OPEC created the following news update (which is the same as the old news):OPEC to leave oil production and exports unchanged.

July 4, 2002 6:50am

06/27/2002

OPEC is to leave its oil production and exports unchanged after its meeting in Vienna, Austria, which was held on 26 Jun 2002. OPEC's oil production and exports will stay on the lowest level over the past 10 years also in 3Q 2002 consequent on low demand. This is supposed to keep oil prices at least on the level of USD 25/barrel. OPEC introduced limits for its total oil deliveries at the beginning of 2002. Then the countries lowered oil production by 1.9 M/d barrels to 21.7 M/d barrels. At the beginning of 2002 OPEC non-members, namely Russia, Norway and Mexico, expressed their loyality too by planning to lower their oil production to raise world prices. Financial Times Information Limited - Asia Africa Intelligence Wire

There are other US experts, such as Dr. Dermot Gately, from NY University, who furthermore believe that since OPEC has not changed their oil production rate for the past three decades, they will not in the future. Dr. Gately presented his findings at the 2001 DOE Annual Energy Outlook Conference in Washington, DC. His position is that, since the revenue per barrel will not increase, there is

"too little incentive for them to increase their output so rapidly." His revealing "price per output" charts, contradicts the DOE and the IEA misinterpretation of OPEC intentions (see attached). The charts clearly show that production activity for OPEC in thirty years has never exceeded 30 mbd. In fact, after reaching such a schedule in 1973, OPEC vacillated for a while and then slowly cut back to 20 mbd in 1985 before gradually increasing again. Such oscillation in a chaotic system such as OPEC will probably continue. Therefore, we are more likely due for another, more severe cutback from OPEC. It would actually be the best thing to happen for the US, the only country in the world who does not conserve oil or gasoline, to help wean us off of the present addiction to the millions of barrels per day of black, liquid death from fossils.EIA also has side-stepped and essentially avoided the tendency for OPEC to maintain a constant or even reduced production schedule, especially since the experts indicate many problems with the "tight" system it represents (with no excess available to take up any slack). In 2000, all the Secretary of Energy Richardson could say was

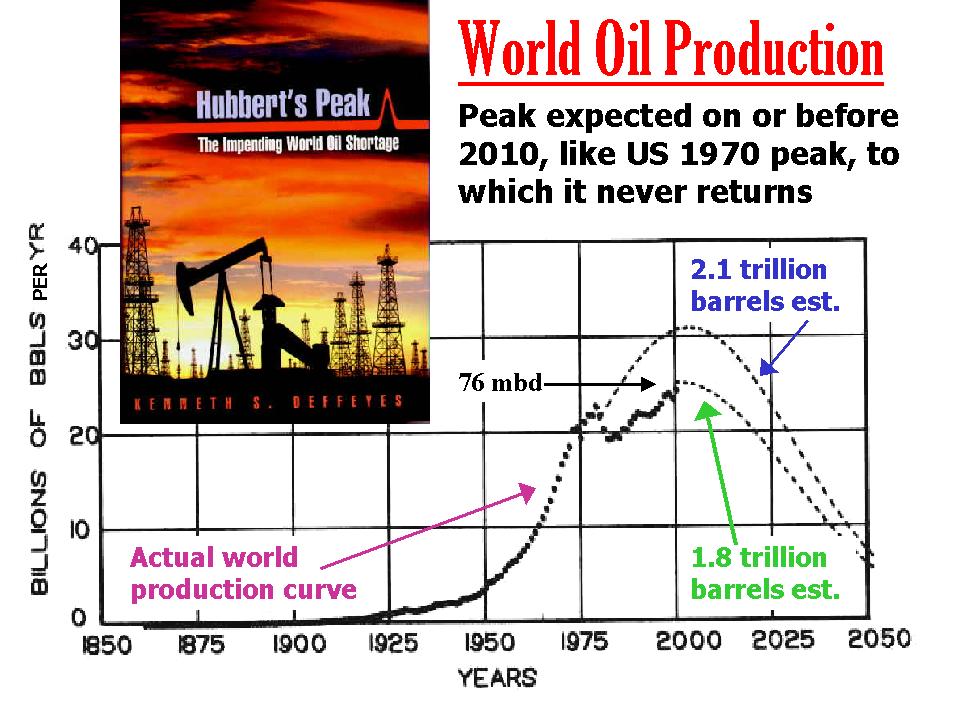

"We were caught napping...We did not think that the 11 members of OPEC could close ranks enough to limit supplies" (Wash Post, 2-27-00). How the DOE could sound so stupid then and still deceive the public today (two years later) is incomprehensible. It seems more likely that the DOE is welcoming another crisis when OPEC offers another 2% cut in production (only 200,000 barrels of oil short for our import quota). The EIA Assumptions to the AEO 2002 on the web also are surreptitiously deceiving the public about the danger and severity of its over-optimism. Besides oil pricing guesses, the only indication that an extraordinary leap in imagination for 2020 has been made by EIA about OPEC is the cryptic comment in the World Oil Markets section, "...and thus full market consequences, such as the consumption or price impacts, are not captured." The public has apparently been forewarned, even though Hutzler above wants to make the completely different assumption that "sufficient capital to expand production capability" is all that is necessary to double OPEC output. OPEC already has sufficient capital, doesn’t EIA know this?Lastly, as I indicated when interviewed on CNN Moneyline, June 25, 2002 the book, Hubbert's Peak, The Impending World Oil Shortage by Deffeyes should be a warning and a wake-up call to those who are not aware of the 2010 peak in world oil production (see attached). Hubbert was right on the money 15 years before it happened in the US production curve and it is likely he is not too far off for the world oil production peak. THE OIL PEAK IS THE MAXIMUM PRODUCTION THE CURVE REACHES BEFORE IT DESCENDS, NEVER TO RETURN. It is wiser to act now rather than to wait.

What possible excuse could EIA have for such a huge mistake about the future? Were you caught napping again?

Sincerely,

Thomas Valone, MA, PE

President

Integrity Research Institute

1220 L St. NW #100-232

Washington, DC 20005